2018 PROXY STATEMENT Notice of Annual Meeting May 23, 2018 New York, New York

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ||||||

| ☐Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2))

| |||||

| ||||||

☐ Definitive Additional Materials

| ||||||

☐ Soliciting Material Pursuant to

|

BlackRock, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ||||||||||

☒ | No fee required.

| |||||||||

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11.

| |||||||||

| 1) | Title of each class of securities to which transaction applies:

| |||||||||

| 2) | Aggregate number of securities to which transaction applies:

| ||||||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which

| ||||||||

| 4) | Proposed maximum aggregate value of transaction:

| ||||||||

| 5) | Total fee paid:

| ||||||||

☐

| Fee paid previously with preliminary materials.

| |||||||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |||||||||

| 1) | Amount Previously Paid:

| |||||||||

| 2) | Form, Schedule or Registration Statement No.:

| ||||||||

| 3) | Filing Party:

| ||||||||

| 4) |

| Date Filed:

| ||||||||

2018 PROXY STATEMENT Notice of Annual Meeting May 23, 2018 New York, New York

Generating Long-Term

ShareholderDelivering Value

to All

BlackRock’s mission isStakeholders to provide better financial futures for our clients. Our framework for creating long-term shareholder value is directly aligned with that mission.Generate

Durable Returns For

Shareholders

BlackRock, Inc. (“BlackRock” or the “Company”) has strategically investedis a global asset manager with approximately 16,500 employees in more than 30 countries. Our purpose is to help more and more people experience financial well-being and we do this by helping millions of people invest to build savings, making investing easier and more affordable, advancing sustainable investing and contributing to a broad,more resilient economy. By operating with a strong sense of purpose each and every day, we position ourselves to deliver better outcomes for clients no matter the market environment, create opportunities for employees, support communities and generate more consistent financial results for shareholders.

We have continuously invested in our business to build the world’s largest and most comprehensive investment platform across active and index funds, with solutions ranging from illiquid alternatives to cash management strategies. Our diverse investment platform strongis supported by our technology and risk management capabilitiessystem, Aladdin®, which helps us better identify risks and a global footprint to meet clients’ needs in all market environments.

Our diverseopportunities and make portfolios more resilient for our clients. The stability of BlackRock’s globally integrated asset management and technology platform enables us to generatedrives strong, long-term performance and consistent financial results, which allows us to continuously and continuouslydeliberately invest in our business through market cycles. We believe that continuously investing in our platform to meet clients’ evolving needs enables usand enhances BlackRock’s ability to:

| Generate | Leverage our scale

| Return capital to | ||||||||

| differentiated | for the benefit of all |

| ||||||||

| organic growth | stakeholders |

| ||||||||

| ||||||||||

ThisOver the long term, BlackRock has delivered on each of these pillars. We have generated differentiated organic growth and delivered operating margin expansion. We have prioritized investment in our business to first drive growth and then returned excess cash flow to shareholders. Our capital return strategy has been balanced between dividends, where we target a 40-50% payout ratio, and a consistent share repurchase program.

Our framework for generating long-term shareholder value was developed in close collaboration with our Board of Directors (the “Board”), and the Board continues to play an active role in overseeingactively oversees our broader strategy and in measuring our ability to successfully execute it.

BlackRock remains focused on investing for the future. Throughout BlackRock’s history, we have demonstrated an ability to optimize organic growth in the most efficient way possible while prudently returning capital to shareholders. We prioritize investment in our business to first drive growth and then return “excess” cash flow to shareholders. Our capital return strategy is balanced between dividends, where we target a 40-50% payout ratio, and a consistent share repurchase program.

In 2018,2021, we will continue to strategically and efficiently invest in BlackRock’sBlackRock to optimize future –growth to growbenefit all of our stakeholders. We will accelerate investments in areas we believe have high growth potential such as ETFs, illiquid alternatives and technology; keep active management at the heart of BlackRock; lead as a whole portfolio advisor across asset managementclasses; and technology capabilities, to expandfurther integrate sustainability across our geographic footprint and to further enhance our talent – to ensure we are meeting our daily responsibilities to our clients and delivering financial returns for shareholders.platform.

“The hardships experienced by people globally in 2020, and the inequities further exacerbated by the pandemic, have only strengthened BlackRock’s sense of responsibility to help millions of people invest to build savings; make investing easier and more affordable; advance sustainable investing; and contribute to a more resilient economy.” Laurence D. Fink Chairman and Chief Executive Officer |

BlackRock, Inc.

55 East 52nd Street

New York, New York, 10055

April 13, 2018[●], 2021

To Our Shareholders:

ThankJust as BlackRock is a fiduciary to our clients, helping them invest for the future, I recognize many of you are investing in BlackRock to achieve your own long-term goals and I want to thank you for your continued support and confidence in BlackRock. It is my pleasureour company. More than 13 months after COVID-19 became a global health crisis, we are still confronting its impacts daily. On behalf of BlackRock and our Board of Directors, we hope that you and your loved ones are staying healthy and safe.

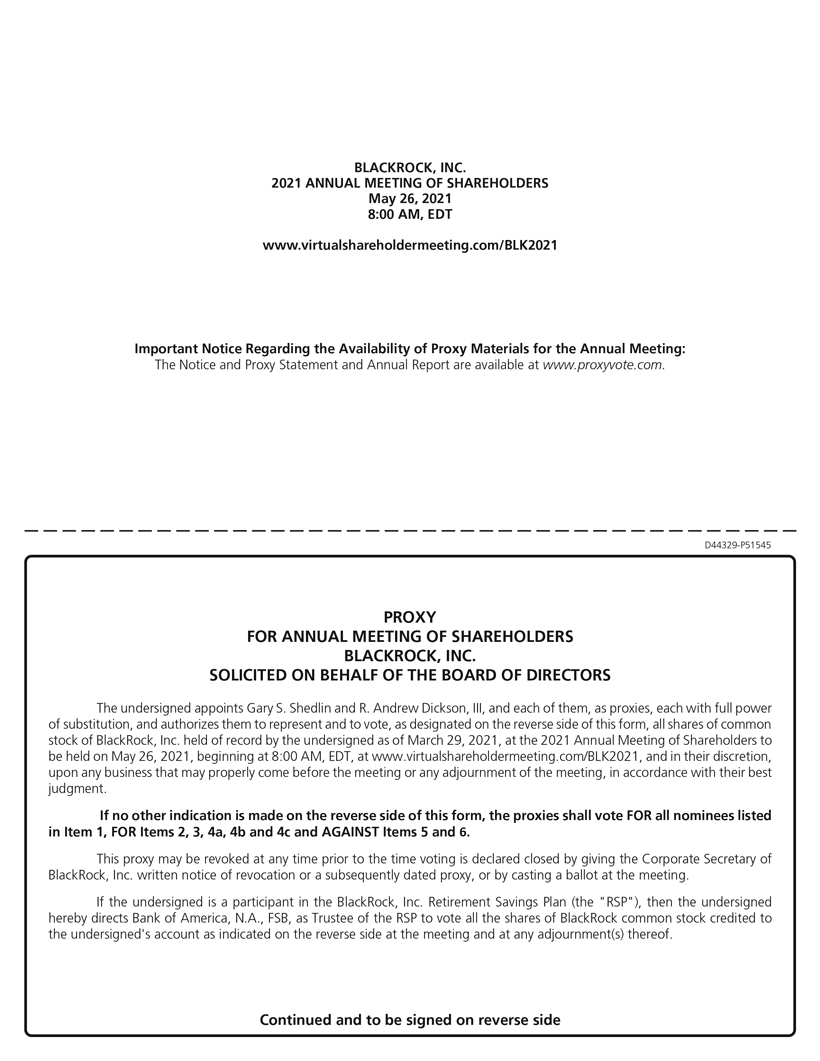

In consideration of continued health concerns relating to inviteCOVID-19, we are once again holding BlackRock’s Annual Meeting of Shareholders virtually. We welcome you to our 2018 Annual Meeting, to be heldjoin us on May 23, 201826, 2021 at 8:00 a.m. EDT at www.virtualshareholdermeeting.com/BLK2021. You may vote your shares via the Lotte New York Palace Hotel.Internet and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BLK2021. As we do each year, we will review our business and financial results for the year, address the voting items in thethis year’s Proxy Statement and take your questions. WhetherRegardless of whether you plan to attendjoin the meeting, or not, your vote is important, and we encourage you to review the enclosed materials and submit your proxy.

As BlackRock celebrates its 30th anniversary thisOver the past year, I have the opportunity to reflectCOVID-19 pandemic has enveloped the entire globe and changed it permanently. It has both exacted a horrific human toll and transformed the way we live – the way we work, learn, access medicine, and much more. While we face great challenges ahead on the most pressing issues facing investors todaypath to recovery, I am a long-term optimist and how BlackRock must continueam encouraged by the positive societal changes that are emerging from this pandemic. As I wrote in January, we are seeing an acceleration in the tectonic shift towards sustainability and people, companies and governments working together to adaptconfront the global threat of climate change. In one of the great triumphs of modern science, multiple vaccines were developed in record time. And importantly, the pandemic has amplified the need for companies to operate with a clear sense of purpose and serve clients’ needs effectively. Itall of their stakeholders – customers, employees and communities – in order to deliver long-term, durable returns for their shareholders.

I am incredibly proud of BlackRock’s unwavering commitment to living our purpose and maintaining a clear long-term vision throughout these challenging times. The hardships experienced by people globally in 2020, and the inequities further exacerbated by the pandemic, have only strengthened BlackRock’s sense of responsibility to help millions of people invest to build savings; make investing easier and more affordable; advance sustainable investing; and contribute to a more resilient economy.

Our strong 2020 performance is a great privilegetestament to the trust our clients place in us to help them navigate uncertain markets and responsibilityour ability to manage the assets entrusted to us, most of which are invested for long-term goals such as retirement. Just as we believe in the importance and benefits of clients investing for the long-term, we also approach BlackRock with that same future perspective. You can find more detail about BlackRock’s purpose and strategy for future growth in my letter to shareholders in this year’s Annual Report.

In 2017, BlackRock continued to deliver on each component of our framework for creating long-term shareholder value, while simultaneously investing in our business.meet their needs. Our diverse global investment platform – with active and index strategies across all asset management platform, industry leadingclasses, integrated technology, data and risk management, capabilities and thought leadership enabledglobal scale and connectivity enables us to generate $367deliver strong and consistent investment performance and more stable outcomes for clients. Our differentiated approach is resonating with clients and, as a result, they entrusted BlackRock with $391 billion of net new assets in 2020. We saw incredible momentum across our entire business during the year: we generated record net inflows into active equity, sustainable, cash and alternative strategies and had more than $1 billion of net inflows during the year, representing 7% organic asset growthin each of 19 countries and 104 different products, reflecting the truststrength and depth of our diversified platform. Our technology services business eclipsed $1 billion in annual revenue for the first time, as the pandemic has accelerated the need for robust operating and risk management technology. And we have earned from clients to help solve their most difficult investment challenges. We continued to investexecuted on our shareholder value framework by delivering revenue, operating income and earnings growth. After investing back in our business for future growth while simultaneously expandingto serve all our operating margin andstakeholders, we returned $2.8approximately $3.8 billion of cash to shareholders through a combination of dividends and share repurchases.

The executionstrength and consistency of BlackRock’s results, regardless of the market environment, are directly linked to our strategy is dependent on adiverse and engaged Board, and strong corporate governance framework. Whether acting as a fiduciary for clients or shareholders, we believe that good corporateand sustainability frameworks. BlackRock’s Board plays an integral role in our governance, is critical to meeting our overall objectives. That includes engaging with you, our shareholders, to better understand and address issues that are important to you. To support our mission of creating better financial futures for clients, we are vocal advocates for the adoption of sound corporate governance policies that include strong Board leadership, prudent management practices and thoughtful strategic deliberations. We believe that BlackRock has implemented such a set of principles, guidelines and practices that support sustainable financialstrategy, growth and long-term value creation for shareholders and hope that you will agree as you read the Proxy Statement.

success. It has always been important that BlackRock’sour Board of Directors functions as a key strategic and governing body that both challenges and advises our leadership team and guides BlackRock into the future. It is also critical that we have a robust corporate governance framework to be betterensure we are executing on our strategy, fulfilling our fiduciary responsibilities to clients and serving all of our stakeholders over the long-term.

BlackRock is committed to living our purpose of helping more and more innovative. BlackRock’s Board continues to play an integral rolepeople experience financial well-being. It is critical that we continue aggressively investing in our governance, growthbusiness to serve clients, inspire our employees and success.support our communities, so we can continue delivering durable profits for you, our shareholders, and make a positive impact on society. Now, more than ever, compassion and forward-thinking will be essential to our future.

Thank you again for your continued commitment to BlackRock. Our Board of DirectorsBlackRock and I look forwardhope to seeingsee you on May 23, 2018 in New York City.person next year.

Sincerely,

Laurence D. Fink

Chairman and Chief Executive Officer

Just as we believe in the importance and benefits of clients investing for the long-term, we also approach BlackRock with that same future perspective.

Notice of 2018

Annual Meeting

of Shareholders

Annual Meeting of Shareholders

PRELIMINARY COPY — SUBJECT TO COMPLETION

Notice of 2021

Annual Meeting of

Shareholders

Annual Meeting of Shareholders

| ||||||||||||||

| Date & Time |

| Location | |||||||||||

| Record Date

| |||||||||||||

|

| |||||||||||||

| www.virtualshareholdermeeting.com/ | Monday, March 29, | ||||||||||||

| 8:00 a.m. EDT | BLK2021 | |||||||||||||

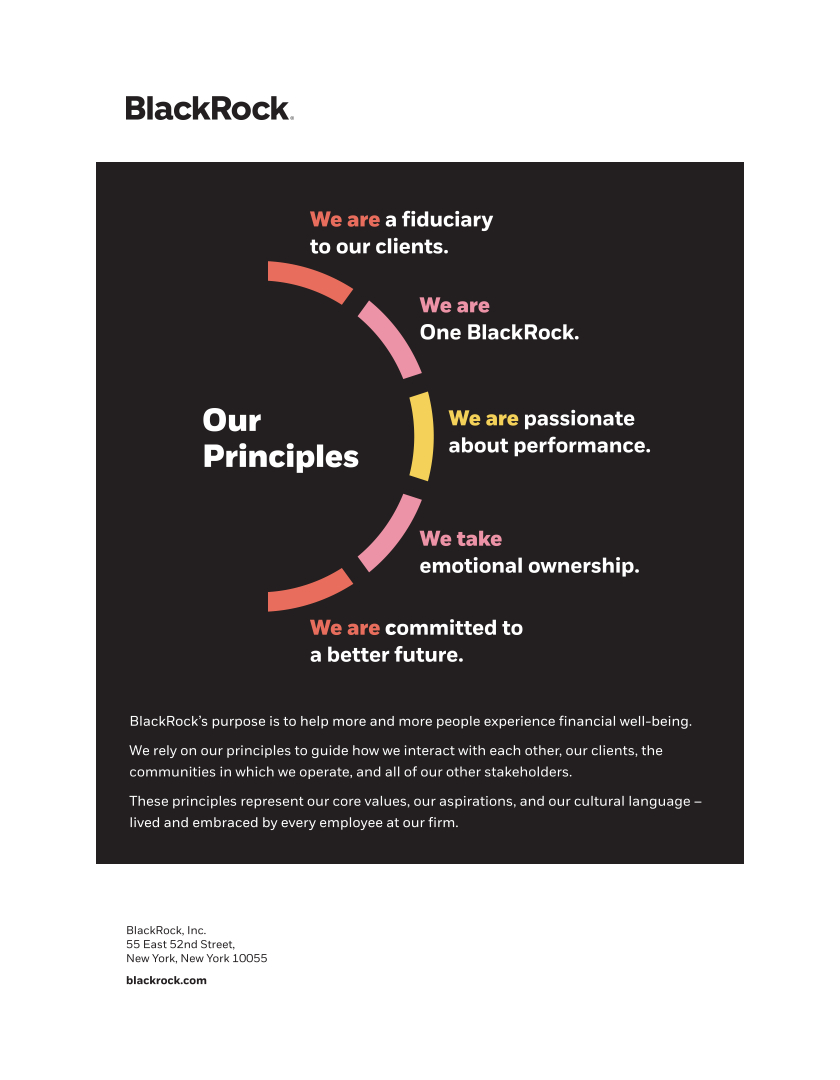

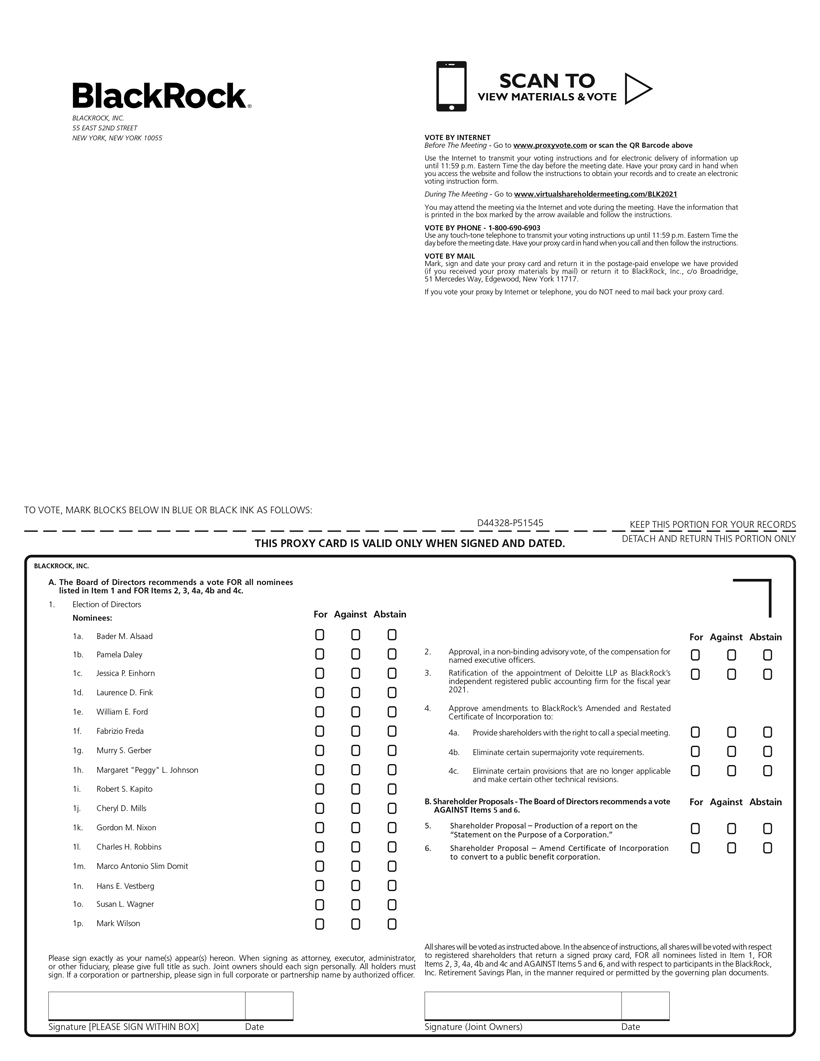

Agenda and Voting Matters

At or before ourthe 2021 Annual Meeting of Shareholders (“Annual Meeting”), we ask that you vote on the following items:

Proposal | Board Recommendation | Page Reference | ||||||

Item 1 Election of Directors |  | Vote FOR each director nominee |

| |||||

|

| |||||||

Item 2Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers |  | Vote FOR | 53 | |||||

Item 3 Ratification of the Appointment of the Independent Registered Public Accounting Firm |  | Vote FOR | 91 | |||||

Items 4A-4CApproval of Amendments to Our Amended and Restated Certificate of Incorporation (the “Charter”) to (i) provide shareholders with the right to call a special meeting, (ii) eliminate certain supermajority vote requirements and (iii) eliminate certain provisions that are no longer applicable and make certain other technical revisions |  | Vote FOR | 94 | |||||

Item 5 Shareholder Proposal – Production of a Report on the “Statement on the Purpose of a Corporation” |  | Vote AGAINST |

|

|

| |||

Item 6 Shareholder Proposal – Amend Certificate of Incorporation to Convert to a Public Benefit Corporation |  | Vote AGAINST |

|

|

| |||

Your vote is important — How to vote:

| Internet |

| ||||||

| Complete and sign the proxy card and return it in the enclosed postage pre-paid envelope. | |||||||

| Telephone |

| During the Meeting | |||||

If your shares are held in the name of

|

|

| ||||||

Please note that we are furnishing proxy materials and access to our Proxy Statement to our shareholders via our website instead of mailing printed copies to each of our shareholders. By doing so, we save costs and reduce our impact on the environment. Beginning on April [●], 2021, we will mail or otherwise make available to each of our shareholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy materials and vote online. If you attend the Annual Meeting virtually, you may withdraw your proxy and vote online during the Annual Meeting if you so choose. Your vote is important and we encourage you to vote promptly, whether or not you plan to attend the Annual Meeting. By Order of the Board of Directors,

|

|

It’s easier and faster to receive future shareholder materials electronically. Remember, you can change your preference at any time. To sign up for electronic delivery: If your shares are registered in your name, please visit www.proxyvote.com and follow the instructions. If your shares are held in the name of a broker, bank or other nominee, please contact them for instructions on how to sign up for electronic delivery. | |||||

| |||||||

R. Andrew Dickson III Corporate Secretary April [●], 2021 | BlackRock, Inc. 55 East 52nd Street, New York, New York 10055 | ||||||

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be held on Wednesday, May 26, 2021: our Proxy

Statement and 2020 Annual Report are available free of charge on our

website at http://ir.blackrock.com/

| Index of Frequently Requested Information |

| |||||||||||

| BlackRock’s Impact on its People | 38 |

| ||||||||||

| Sustainability at BlackRock | 36 |

| |||||||||

| Board Diversity | 13 |

| |||||||||

| CEO Pay Ratio | 89 |

| |||||||||

| Clawback Policy | 80 | ||||||||||

| Director Independence | 12 | |||||||||||

| Hedging and Pledging Policy | 80 | |||||||||||

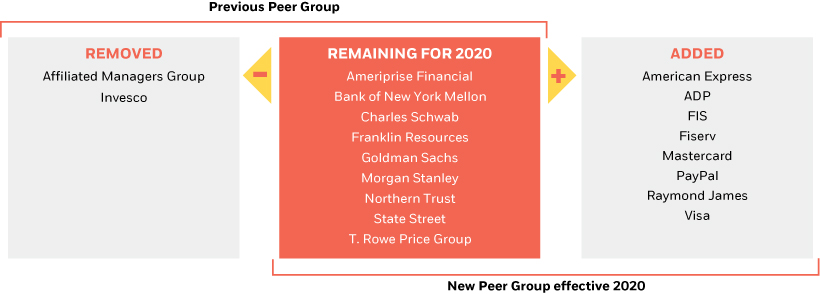

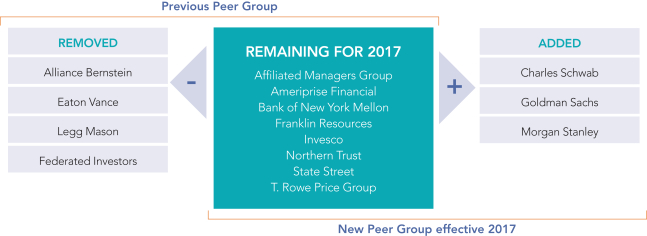

| Peer Group | 66 | |||||||||||

| Public Policy Engagement | 42 | |||||||||||

| Stock Ownership Guidelines for Directors | 44 | |||||||||||

| Stock Ownership Guidelines for NEOs | 80 | |||||||||||

|

|

|

| |||||||||

Please note that we are furnishing proxy materials and access to our Proxy Statement to our shareholders via our website instead of mailing printed copies to each shareholder. By doing so, we save costs and reduce our impact on the environment.

BLACKROCK, INC. 2021 PROXY STATEMENT

Beginning on April 13, 2018, we will mail or otherwise make available to each of our shareholders a Notice of Internet Availability of Proxy Materials, which contains instructions about how to access our proxy materials and vote online. If you attend the

Helpful Resources

Where You Can Find

More Information

Annual Meeting you may withdraw your proxy and vote in person, if you so choose.

Proxy Statement:

http://ir.blackrock.com/financials/annual-reports-and-proxy

Annual Report:

http://ir.blackrock.com/financials/annual-reports-and-proxy

Voting Your vote is important and we encourage you to vote promptly whether or not you plan to attendProxy via the 2018 Internet Before the

Annual Meeting of Shareholders of BlackRock, Inc.Meeting:

By Order of the www.proxyvote.com

Board of Directors

http://ir.blackrock.com/board-of-directors

http://ir.blackrock.com/governance-overview under the heading

“Contact Our Board of Directors”

Governance Documents

http://ir.blackrock.com/governance-overview

Investor Relations

http://ir.blackrock.com

Sustainability

www.blackrock.com/corporate/sustainability

Other

Public Policy “Insights”:

www.blackrock.com/corporate/insights/public-policy

Lobbying Disclosure Act:

www.senate.gov/legislative/lobbyingdisc.htm

Federal Election Commission:

www.fec.gov/data/reports/pac-party

Definition of Certain Terms

or Abbreviations

|

|

Important Notice Regarding the Availability of Proxy Materials for the 2018 AnnualMeeting of Shareholders to be held on Wednesday, May 23, 2018: our ProxyStatement and 2017 Annual Report are available free of charge on our website atwww.blackrock.com/corporate/en-us/investor-relations

| AUM | Assets under Management | ||||

| Chief Executive Officer | |||||

| CFO | Chief Financial Officer | ||||

| Committees | The Audit, Management Development & Compensation, Nominating, Governance & Sustainability, Risk and Executive Committees | ||||

| Compensation Committee | Management Development & Compensation Committee | ||||

| COO | Chief Operating Officer | ||||

| Deloitte | Deloitte & Touche LLP | ||||

| ESG | Environmental, social and governance | ||||

| GAAP | Generally Accepted Accounting Principles in the United States | ||||

| GEC | Global Executive Committee | ||||

Committee | Nominating, Governance & Sustainability Committee | ||||

| NEO | Named Executive Officer | ||||

| NTM | Next Twelve Months | ||||

| NYSE | New York Stock Exchange | ||||

| PAC | Political Action Committee | ||||

| PNC | The PNC Financial Services Group, Inc. | ||||

| RSU | Restricted Stock Unit | ||||

| SEC | Securities and Exchange Commission | ||||

Peers | |||||

| T. Rowe Price | |||||

BLACKROCK, INC. 2021 PROXY STATEMENT 1

This summary provides an overview of selected information in this year’s Proxy Statement. We encourage you to read the entire Proxy Statement before voting.

Annual Meeting of Shareholders

|

| |||||||||||||

| Date & Time |

| ||||||||||||

| Location |

|

Record Date | ||||||||||||

|

| |||||||||||||

| www.virtualshareholdermeeting.com/ | Monday, March 29, | ||||||||||||

| 8:00 a.m. EDT | BLK2021 | |||||||||||||

Voting Matters

Shareholders will be asked to vote on the following matters at the Annual Meeting:

Board Recommendation | Page Reference | ||||||||||

ITEM 1.Election of Directors

The Board believes that each of the director nominees |

| Vote FOR each | 11 | ||||||||

ITEM 2.Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers

BlackRock seeks anon-binding advisory vote from its shareholders to approve the compensation of the |  |

| VoteFOR | 53 | |||||||

ITEM 3.

|

| ||||||||||

The Audit Committee has appointed Deloitte |  |

Vote FOR | 91 | ||||||||

ITEMS 4A-4C.Approval of Amendments to Our Charter The Board recommends that shareholders approve amendments to BlackRock’s Charter, which would (i) provide shareholders with the right to call a special meeting, (ii) eliminate certain supermajority vote requirements and (iii) eliminate certain provisions that are no longer applicable and make certain other technical revisions. |  |

VoteFOR | 94 | ||||||||

ITEM 5.Shareholder Proposal

The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. |  |

| VoteAGAINST | 99 | |||||||

BLACKROCK, INC. 2018 PROXY STATEMENT 1

ITEM 6. Shareholder Proposal – Amend Certificate of Incorporation to Convert to a Public Benefit Corporation The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. |  | Vote AGAINST | 102 | ||||||||||||

|

| |||

|

|

Proxy Summary | Governance Highlights

What’s New?

We continually review our approach to corporate governance, culture, sustainability and compensation to make certain that BlackRock is in a position to consistently deliver on its commitment to sustaining a culture of high performance, collaboration, innovation and fiduciary responsibility. We believe providing a broader understanding of our perspectives on these items will be beneficial to you as you consider this year’s voting matters. This year’s updated items include:

| • |

|

• |

|

| • | Enhanced disclosure on human capital management, including our Diversity, Equity and Inclusion strategy – see “BlackRock’s Impact on its People” on page 38 |

| • | Enhanced disclosure on Board diversity – see “Board Profile and | |||

|

| |||

|

| |||

|

|

Board Composition

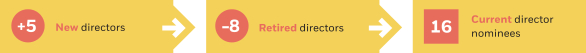

(1816 director nominees)

The NominatingBoard believes that its size, albeit larger than the average public company board, is imperative to achieving the diversity of thought, experience and geographical expertise necessary to oversee our large and complex global business. The range of insights and experience of our Board supports BlackRock’s business and strategic growth areas, which include our diverse platform of alpha-seeking active, index and cash management investment strategies across asset classes, as well as technology services and advisory services and solutions.

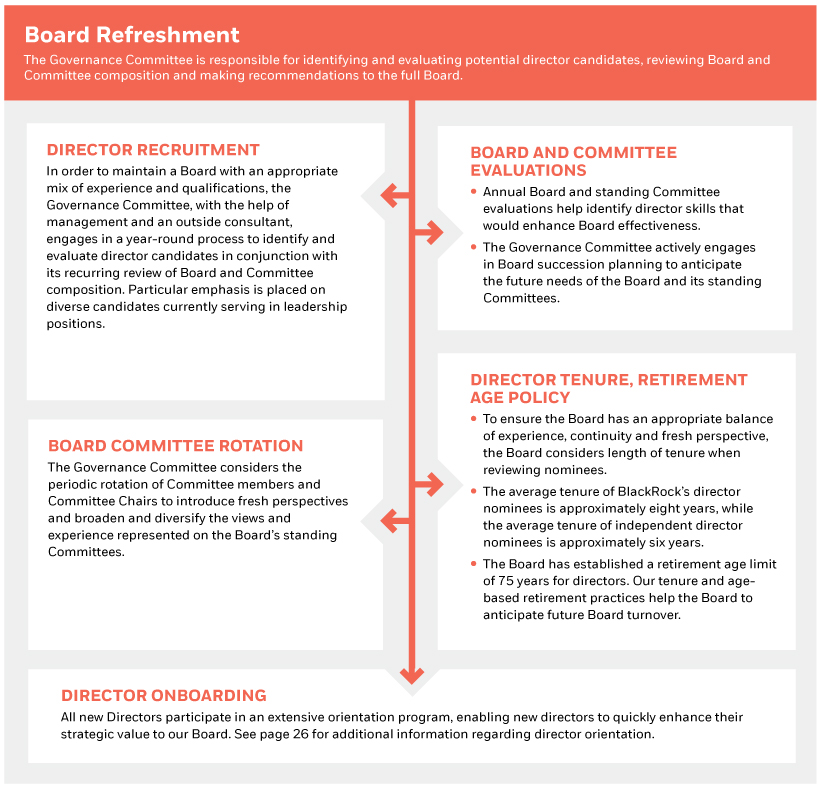

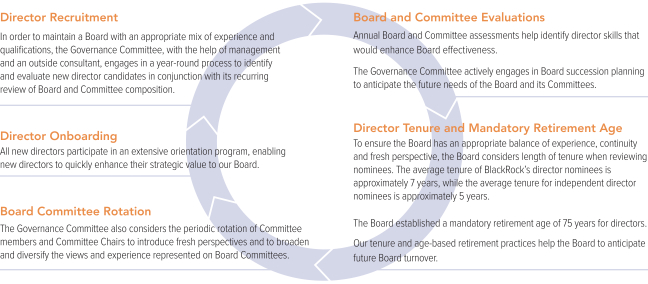

The Governance Committee (the “Governance Committee”) regularly reviews the overall composition of the Board and its Committees to assess whether they reflectit reflects the appropriate mix of skill sets,skills, experience, backgrounds and qualifications that are relevant to BlackRock’s current and future global strategy, business and governance. Over the course of the past year, the Governance Committee identified three new candidates with strong senior executive, international, technology and financial services experience who were elected to the Board in March of this year.strategy.

Board Tenure(1)

The Board considers length of tenure when reviewing nominees in order to maintain an overall balance of experience, continuity and fresh perspective.

| 8 years: Average tenure of | |

all director nominees | ||

6 years: Average tenure of | ||

independent director nominees | ||

Board Refreshment

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience and qualifications, introduce fresh perspectives and broaden and diversify the views and experience represented on the Board.

Over the past 5 years:

| (1) | Percentages do not sum to 100% due to rounding. |

|

|

|

| |||

|

Proxy Summary | Governance Highlights

5 director nominees

(28%)

6 director nominees

(33%)

5 years:Average tenure of independent director nominees

Board Profile

|

|  |

|  |

|

Board Independence and Lead Independent DirectorLeadership

Each year the Board reviews and evaluates our Board leadership structure. The Board has appointed Laurence D. Fink as its Chairman and Murry S. Gerber as its Lead Independent Director.

Board Profile and Diversity

The partnership and oversight of a diverse board with proven leadership experience is essential to creating long-term shareholder value.

BlackRock and its Board believe diversity in the boardroom is critical to the success of the Company and its ability to create long-term value for our shareholders. The diverse backgrounds of our individual directors help the Board better oversee BlackRock’s management and operations and assess risk and opportunities for the Company’s business model from a variety of perspectives. |

| |||||||

Director self-identification of race/ethnicity: • 1 Black / African American • 1 Hispanic / Latin American • 1 Middle-Eastern / North African |

The Board has and will continue to make diversity in gender, race/ethnicity, age, career experience and nationality – as well as diversity of mind – a priority when considering director candidates.

Board and Committee Oversight of Environmental, Social and Sustainability Matters

BlackRock’s governance of climate and sustainability-related matters reflects our commitment to strong leadership and oversight at the senior management and Board levels. BlackRock’s Board engages with senior leaders on near- and long-term business strategy and reviews management’s performance in delivering on our framework for long-term value creation, including as it relates to sustainability. Additionally, the Governance Committee is directly responsible for overseeing:

| Investment Stewardship |  | Social Impact |  | Corporate Sustainability |  | Public Policy | |||||||||||||||||||||

The Governance Committee periodically reviews corporate and investment stewardship-related policies, programs and significant publications relating to environmental (including climate change), social and other sustainability matters. | The Governance Committee reviews BlackRock’s philanthropic program (“Social Impact”) and its strategy, which is focused on efforts to support a more inclusive and sustainable economy. | The Governance Committee periodically reviews BlackRock’s corporate sustainability program, including through reports from BlackRock’s Corporate Sustainability team, which is responsible for overseeing efforts to incorporate sustainability into BlackRock’s business practices, operations and strategy and setting environmental sustainability objectives and strategy for our operations. | The Governance Committee has oversight of the Company’s corporate political activities and periodically reviews BlackRock’s public policy and advocacy activities, including public policy priorities, political contributions and memberships in trade associations. | |||||||||||||||||||||||||

Governance Committee oversight provides an additional layer of accountability to assist in BlackRock’s progress on these important initiatives for the benefit of all stakeholders. As appropriate, the Governance Committee makes recommendations on these matters to the full Board.

4 | BLACKROCK, INC. 2021 PROXY STATEMENT |

|

2BLACKROCK, INC. 2018 PROXY STATEMENT

Proxy Summary | Governance Highlights

Our Director Nominees

Age at | Committee Memberships (effective following the Annual Meeting)

| |||||||||||||||||||

Nominee | Primary Occupation | Director since | Audit | Compensation | Governance | Risk | Executive | |||||||||||||

Bader M. Alsaad | 63 | Chairman of the Board and Director General of the Arab Fund for Economic & Social Development | 2019 |

|

|

|

| ● | ● |

| ||||||||||

Pamela Daley | 68 | Former Senior Vice President of Corporate Business Development, General Electric Company | 2014 | ● |

|

| ● | ● | ||||||||||||

Jessica P. Einhorn | 73 | Former Dean of Paul H. Nitze School of Advanced International Studies at Johns Hopkins University | 2012 |

|

|

| ● |

| ● |

| ||||||||||

Laurence D. Fink | 68 | Chairman and CEO of BlackRock | 1999 |

|

|

|

|

|

| ● | ||||||||||

William E. Ford | 59 | Chairman and CEO of General Atlantic | 2018 |

|

|

| ● | ● |

| ● | ||||||||||

Fabrizio Freda | 63 | President and CEO of Estée Lauder Companies Inc. | 2012 |

|

|

|

| ● |

|

| ||||||||||

Murry S. Gerber Lead Independent Director | 68 | Former Chairman and CEO of EQT Corporation | 2000 | ● |

| ● |

| ● | ||||||||||||

Margaret “Peggy” L. Johnson | 59 | CEO of Magic Leap, Inc. | 2018 | ● | ● |

|

|

| ||||||||||||

Robert S. Kapito | 64 | President of BlackRock | 2006 |

|

|

|

|

|

|

| ||||||||||

Cheryl D. Mills | 56 | Founder and CEO of BlackIvy Group | 2013 |

|

|

| ● | ● |

|

| ||||||||||

Gordon M. Nixon | 64 | Former President and CEO of Royal Bank of Canada | 2015 |

|

|

| ● | ● |

| ● | ||||||||||

Charles H. Robbins | 55 | Chairman and CEO of Cisco Systems, Inc. | 2017 |

|

|

|

|

| ● |

| ||||||||||

Marco Antonio Slim Domit | 52 | Chairman of Grupo Financiero Inbursa, S.A.B. de C.V. | 2011 | ● | ● |

|

|

| ||||||||||||

Hans E. Vestberg | 55 | Chairman and CEO of Verizon Communications, Inc. | N/A | ● |

|

|

|

| ||||||||||||

Susan L. Wagner | 59 | Former Vice Chairman of BlackRock | 2012 | ● |

|

| ● | ● | ||||||||||||

Mark Wilson | 54 | Co-Chairman and CEO of Abacai | 2018 | ● |

|

| ● |

| ||||||||||||

Number of Committee Meetings Held in 2020: |

|

|

| 14 | 9 | 6 | 7 | 0 | ||||||||||||

| ● Chairperson |

| BLACKROCK, INC. 2021 PROXY STATEMENT |  |

Our Director Nominees

Committee Memberships | ||||||||||||||||||

Nominee

| Age at

| Primary Occupation

| Director

| Audit

| Compensation

| Governance

| Risk

| Executive

| ||||||||||

Mathis Cabiallavetta |

73 |

Former Chairman of UBS, Vice Chairman of Swiss Re Ltd. and of Marsh & MacLennan Companies, Inc.

|

2007 | ●

| ●

| ●

| ||||||||||||

Pamela Daley |

65 |

Former Senior Vice President of General Electric Company Corporate Business Development and Senior Advisor to Chairman

|

2014 | Chair | ●

| ●

| ||||||||||||

William S. Demchak

|

55

|

Chairman, CEO and President of The PNC Financial Services Group, Inc.

|

2003

| ●

| ●

| |||||||||||||

Jessica P. Einhorn |

70 |

Former Dean of Paul H. Nitze School of Advanced International Studies at The Johns Hopkins University and former Managing Director, World Bank

|

2012

| ●

| ●

| |||||||||||||

Laurence D. Fink

|

65 |

Chairman and CEO of BlackRock

|

1999

| Chair | ||||||||||||||

William E. Ford

|

56 |

CEO of General Atlantic |

2018 | |||||||||||||||

Fabrizio Freda

|

60 |

President and CEO of The Estée Lauder Companies Inc.

|

2012 | ●

| ||||||||||||||

Murry S. Gerber Lead Independent Director

|

65 |

Former Executive Chairman, Chairman, President and CEO of EQT Corporation |

2000 | ●

| ●

| ●

| ||||||||||||

Margaret L. Johnson |

56 |

Executive Vice President of Business Development of Microsoft Corporation

|

2018 | |||||||||||||||

Robert S. Kapito |

61 |

President of BlackRock

|

2006 | |||||||||||||||

Sir Deryck Maughan |

70 |

Former Senior Advisor, Partner and Managing Director of Kohlberg Kravis Roberts & Co. L.P.

|

2006 | ●

| Chair | ●

| ||||||||||||

Cheryl D. Mills |

53 |

Founder and CEO of BlackIvy Group and former

|

2013 | ●

| ●

| |||||||||||||

Gordon M. Nixon |

61 |

Former President, CEO and Director of

|

2015 | ●

| Chair | ●

| ●

| |||||||||||

Charles H. Robbins |

52 |

Chairman and CEO of Cisco Systems, Inc. |

2017

| ●

| ||||||||||||||

Ivan G. Seidenberg |

71 |

Former Chairman and CEO of Verizon

|

2011 | ●

| Chair | ●

| ●

| |||||||||||

Marco Antonio Slim Domit |

49 |

Chairman of Grupo Financiero Inbursa, S.A.B. de C.V.

|

2011 | ●

| ●

| |||||||||||||

Susan L. Wagner |

56 |

Former Vice Chairman of BlackRock

|

2012 | ●

| ||||||||||||||

Mark Wilson

|

51 |

CEO of Aviva plc

|

2018 | |||||||||||||||

BLACKROCK, INC. 2018 PROXY STATEMENT 3

Proxy Summary | Governance Highlights

Governance HighlightsPractices

We are vocal advocates for the adoption of sound corporate governance policies that include strong Board leadership and strategic deliberation, prudent management practices and transparency.

Highlights of our governance practices include:

Additionally, shareholders are being asked to approve amendments to our Charter at this Annual Meeting, which would further enhance our corporate governance practices by providing shareholders with the right to call a special meeting.

Stock Ownership Guidelines

Our stock ownership guidelines require the Company’s Global Executive Committee (“GEC”)GEC members to own and maintain shares with a target value of:

$10 million for the CEO; $5 million for the President; and $2 million for all other GEC members. As of December 31, 2020, all NEOs exceeded our stock ownership guidelines.

| ||

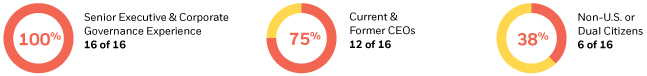

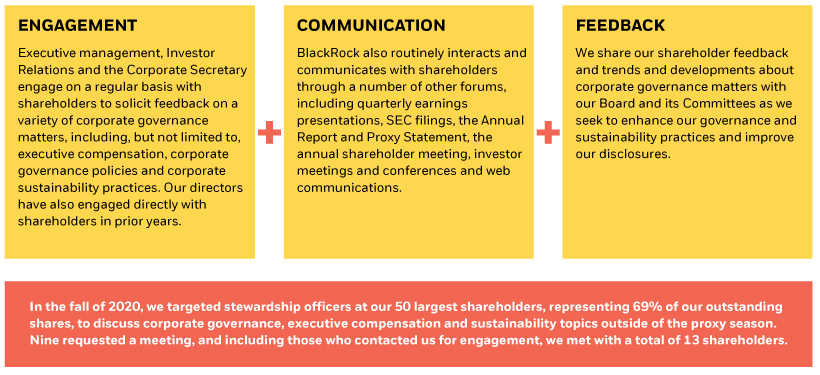

Shareholder Engagement and Outreach

Our Shareholder Engagement Process

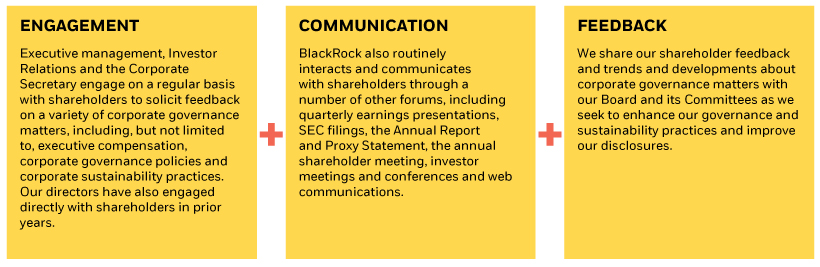

We conduct shareholder outreach throughout the year to engage with shareholders on issues that are important to you.them. We report back to our Board on this engagement and onas well as specific issues to be addressed.

Executive management, Investor Relations

6 | BLACKROCK, INC. 2021 PROXY STATEMENT |

Proxy Summary | Compensation Discussion and the Corporate Secretary engage on a regular basis with shareholders to understand their perspectives on a variety of corporate governance matters, including executive compensation, corporate governance policiesAnalysis Highlights

Compensation Discussion and corporate sustainability practices. We also communicate with shareholders through a number of routine forums, including quarterly earnings presentations, U.S. Securities and Exchange Commission (“SEC”) filings, the Annual Report and Proxy Statement, the annual shareholder meeting, investor meetings and conferences and web communications. We relay shareholder feedback and trends on corporate governance and sustainability developments to our Board and its Committees and work with them to both enhance our practices and improve our disclosures.

Analysis Highlights

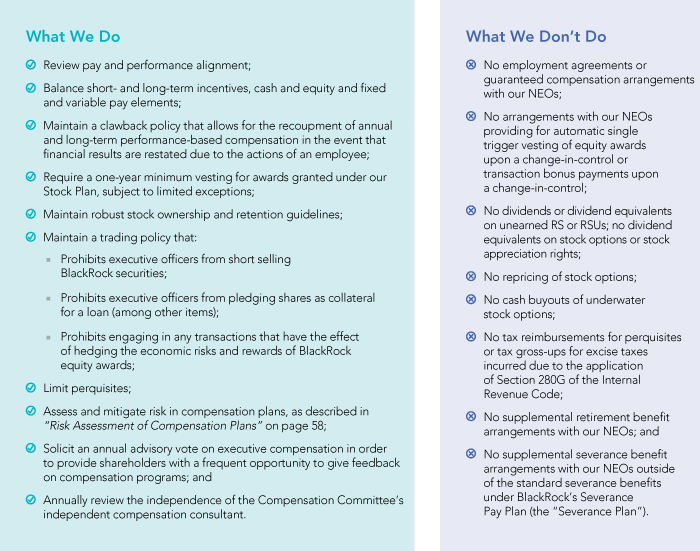

Compensation Policies and Practices

Our commitment to designdesigning an executive compensation program that is consistent with responsible financial and risk management is reflected in the following policies and practices:

| ||||

|

| |||

| ||||

| ||||

| policy that allows for the recoupment of annual and long-term performance-based compensation in the event that financial results require a significant restatement due to the actions of an employee;

| ||||

| Award and Incentive Plan (the “Stock Plan”);

| ||||

| ||||

| securities by Section 16 officers and directors;

| ||||

| ||||

| ||||

| ||||

| ||

|

What We Don’t Do

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

Incentive Program – Pay-for-Performance Highlights

Our total annual compensation structure embodies our commitment to align pay with performance, as highlighted in the following Compensation Discussion and Analysis sections:

4BLACKROCK, INC. 2018 PROXY STATEMENT

what we do what we don’t do

What to Look for | Where to Find it | |||

| Compensation program objectives | “Our Compensation Program” beginning on page 61 | ||

| Performance assessments for NEOs based on weighted, pre-set objectives | “How We Determine Total Incentive Amounts for NEOs” on page 9 | ||

| Assessments include financials as the highest weighted input, including relative and year-over-year performance | “2020 Financial Performance” on page 57 “2020 NEO Compensation and Performance Summaries” beginning on page 68 | ||

| Total incentive outcomes tied to formulaic percentage ranges | “Pay and Performance Alignment for NEOs – Total Incentive Award Determination” on page 58 “NEO Total Annual Compensation Summary” on page 59 | ||

| Actual performance of historical incentive awards | “2017 BPIP Award: Actual Performance and Payout” on page 64 | ||

| BLACKROCK, INC. 2021 PROXY STATEMENT |  |

2017Proxy Summary | Compensation Discussion and Analysis Highlights

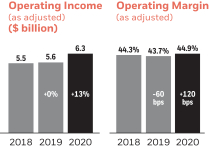

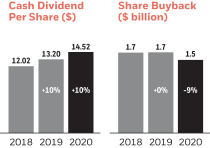

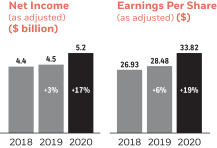

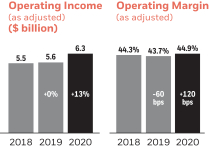

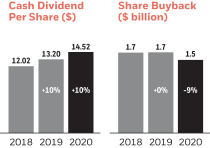

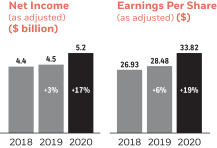

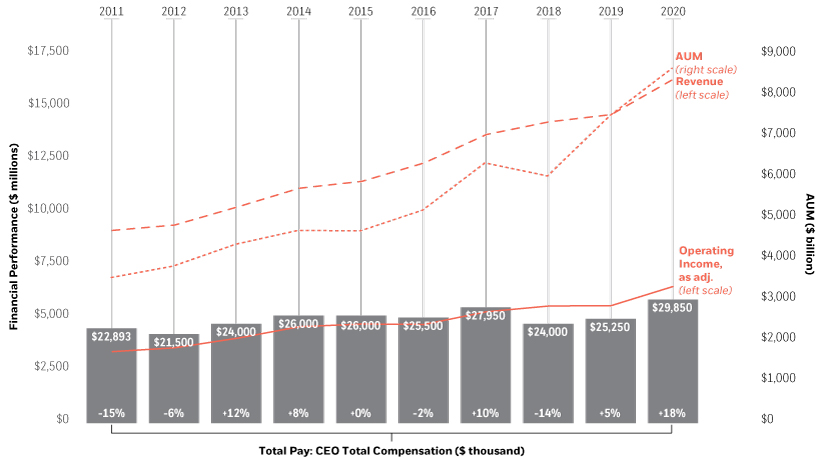

2020 Financial Performance Highlights1(1)

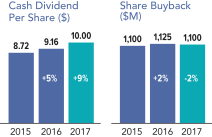

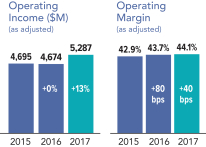

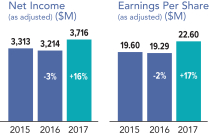

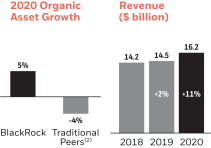

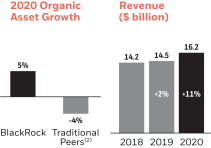

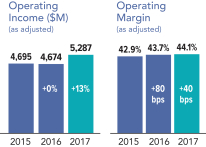

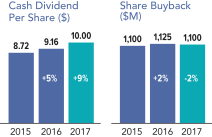

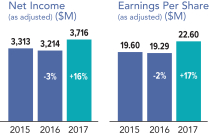

The strength of BlackRock’s 20172020 results reflect our differentiated ability to deliver global insights, strategic advice and comprehensive solutions to our clients in a challenging market environment. We generated $391 billion of total net inflows for the long-term strategic advantages we have created by consistently investingfull year, representing 5% organic asset growth and 7% organic base fee growth. We delivered revenue, operating income and earnings growth, expanded our margin and returned $3.8 billion to shareholders. Despite a volatile market environment and uncertain economic backdrop, BlackRock continued to invest in our business. Full-year results reflected industry-leading organicbusiness to serve all our stakeholders, drive long-term growth with record full-year net inflowsand lead the evolution of $367 billion, continued Operating Margin expansion and consistent capital management. Investmentthe asset management industry. Long-term investment performance results across our alpha-seeking and index strategies as of December 31, 20172020 remain strong and are detailed in Part I, Item 1 – Businessof our 20172020 Form10-K.

Differentiated Organic Growth

Organic Assetgrowth of 7% in 2017

contributed to strong Organic Revenue

growth2

Consistent Capital Return

$2.8 billion was returned to shareholders

in 2017 through a combination of dividends

and $1.1 billion of share repurchases

Operating Leverage

Operating Margin, as adjusted, of 44.1%

was up40 bps from 2016

Earnings Growth

Diluted earnings per share, as adjusted,

of $22.60increased 17% versus 2016

| Differentiated Organic Growth | Operating Leverage | |||

BlackRock generated 5% organic asset | BlackRock improved its Operating Margin, as adjusted, by 120 bps to 44.9% in 2020 | |||

|  | |||

| Consistent Capital Return | Earnings Per Share Growth | |||

BlackRock returned $3.8 billionto | BlackRock grew diluted earnings per share, | |||

|  |

| (1) | Amounts in this section, where noted, are shown on an “as adjusted” basis. For a reconciliation with |

| (2) | Traditional Peers refers to public company asset managers: Alliance Bernstein, Affiliated Managers Group, Franklin Resources, Invesco and T. Rowe Price. |

BLACKROCK, INC. 2018 PROXY STATEMENT 5

Assets Under Management ($B) Revenue ($M) Operating Income ($M) (as adjusted)2 Operating Margin (as adjusted)2 Cash Dividend Per Share ($)Share Buyback ($M) Net Income ($M) Earnings Per Share (as adjusted)2 ($M)

8 |

| 2021 PROXY STATEMENT |

Proxy Summary | Compensation Discussion and Analysis Highlights

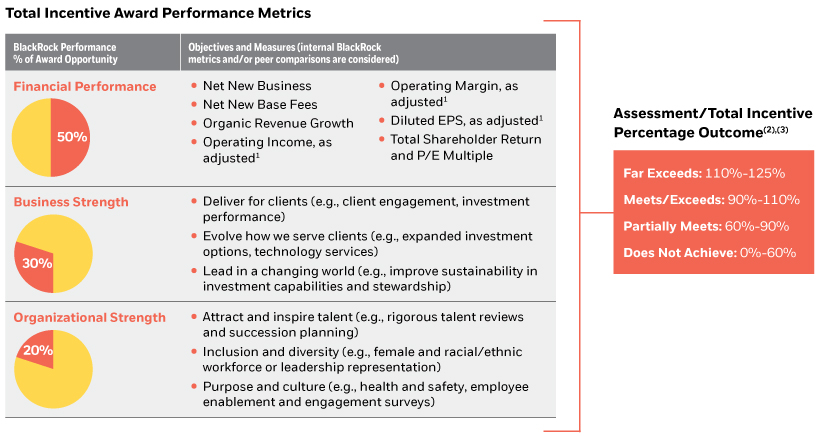

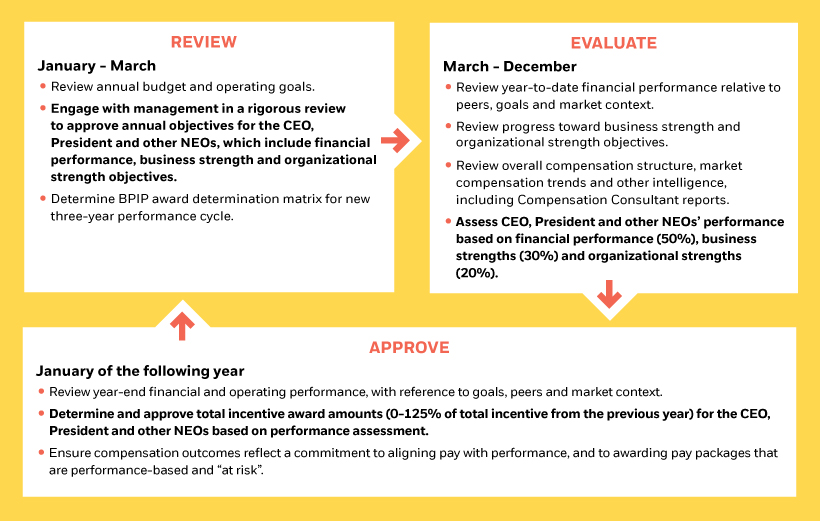

How We Pay NEOs

Each of BlackRock’s NEOs, through their various roles and responsibilities, contributes to the firm-wide objectives summarized below. Under the NEO total incentive award determination framework, the Compensation Committee assesses each NEO’s performance individually, based on three categories, with 50% of the award opportunity dependent on BlackRock’s achievement of financial performance goals, 30% dependent on BlackRock’s progress towards meeting our strategic objectives as measured by our business strength and 20% dependent on BlackRock’s progress towards meeting its organizational priorities. Our commitment to sustainability is incorporated within our Business Strength and Organizational Strength objectives. The Compensation Committee’s performance assessment is directly related to each NEO’s total incentive outcome, which includes all variable pay.

For each NEO’s performance assessment, please refer to the section “2020 NEO Compensation and Performance Summaries” on page 68.

How We Determine AnnualTotal Incentive Amounts

for Our CEO and PresidentNEOs

BlackRock Performance % of Award Opportunity

| Measures

| BlackRock Performance

| ||||||||||||||||

2016

|

2017

|

Change

| ||||||||||||||||

Financial Performance

|

Net New Business ($bn)

|

$202

|

$367

|

+82%

| ||||||||||||||

Net New Base Fee Growth

|

4%

|

7%

|

+300bps

| |||||||||||||||

Operating Income, as adjusted1 ($m)

|

$4,674

|

$5,287

|

+13%

| |||||||||||||||

Operating Margin, as adjusted1

|

43.7%

|

44.1%

|

+40 bps

| |||||||||||||||

Diluted Earnings Per Share, as adjusted1

|

$19.29

|

$22.60

|

+17%

| |||||||||||||||

Share Price Data |

BLK |

LC Traditional Peers2 | ||||||||||||||||

NTM P/E Multiple3

|

20.2x

|

14.3x

| ||||||||||||||||

Annual appreciation

|

35%

|

28%

| ||||||||||||||||

Business Strength

|

Deliver superior client experience through competitive investment performance across global product groups

|

BlackRock’s alpha-seeking investments platform delivered very strong performance in 2017 and improved performance against peers

| ||||||||||||||||

Drive organization discipline through execution of our strategic initiatives |

Demonstrated successful execution across multiple complex strategic initiatives that have positioned the Company well for growth

| |||||||||||||||||

Lead in a changing world |

Elevated the use of technology across the organization and made progress in advancing BlackRock’s technology agenda

| |||||||||||||||||

Organizational Strength

|

Drive high performance |

Advanced the high performance goal through execution of key senior talent moves in 2017

| ||||||||||||||||

Build a more diverse and inclusive culture |

Strong progress in 2017 diverse hiring to meet or exceed company-wide 2020 diversity targets

| |||||||||||||||||

Develop great managers and leaders |

Continued to focus on manager excellence, succession planning, the depth of our leadership bench, and proactive development of key talent

| |||||||||||||||||

BlackRock Performance % of Award Opportunity

| Measures

| Indicative BlackRock Performance Metrics

| ||||

2019 | 2020 | |||||

Financial Performance

| Net New Business ($ billion) | $429 | $391 | |||

Net New Base Fee Growth | 5% | 7% | ||||

Operating Income, as adjusted(1) ($ million) | $5,551 | $6,284 | ||||

Year-over-year change | +0% | +13% | ||||

Operating Margin, as adjusted(1) | 43.7% | 44.9% | ||||

Year-over-year change | - 60bps | + 120bps | ||||

Diluted Earnings Per Share, as adjusted(1) | $28.48 | $33.82 | ||||

Year-over-year change | + 6% | + 19% | ||||

Share Price Data | BLK | Traditional Peers(2) | ||||

NTM P/E Multiple(3) | 20.6x | 10.1x | ||||

Annual appreciation/depreciation | + 44% | + 10% | ||||

Business Strength

|

Deliver for clients | |||||

• Drove exceptional long-term investment performance across BlackRock’s active platform, delivering over $30 billion of alpha for clients in 2020, as over 85% of fundamental active equity, systematic active equity and taxable fixed income assets performed above their respective benchmarks or peer medians for the trailing five-year period. | ||||||

• Expanded ETF investment options to clients, resulting in $185 billion of inflows across iShares® and $89 billion of the net inflows in Fixed Income iShares; launched over 100 new sustainable products. | ||||||

• Aladdin provided operational resilience and risk management for clients amidst record market volatility and increased client demand drove a record $1.1 billion of annual technology services revenue. | ||||||

Evolve how we serve clients | ||||||

• Executed against sustainability commitments, strengthening BlackRock’s ability to serve clients with sustainability research, investment solutions and technology. | ||||||

• Grew the illiquid alternatives platform to $86 billion AUM. Raised a record $25 billion of client capital in 2020, led by infrastructure, private equity solutions and private credit. | ||||||

Lead in a changing world | ||||||

• Quickly responded in supporting clients during the pandemic and volatile markets, leveraging our scale and connectivity to deliver strong investment performance and more stable outcomes for clients. | ||||||

• Focused on advancing racial equity through public policy and legislative outcomes where we operate.

| ||||||

Organizational Strength

|

Attract and inspire talent | |||||

• Increased senior leader accountability of talent and succession, with more rigorous Talent Bench Reviews and the roll-out of sponsorship programs for underrepresented talent. | ||||||

Inclusion and diversity | ||||||

• Progressed toward our senior women leadership target of 30%, increasing 80 basis points from the prior year to 29.7% representation in senior roles at the end of 2020. | ||||||

• Built a strong pipeline of future talent through the most diverse Graduate Analyst Program class yet, with 58% female representation globally and 29% Black and Latinx representation in the U.S. | ||||||

Purpose and culture | ||||||

• Despite the challenging environment, fostered a purpose driven culture globally, which was evidenced by the Employee Opinion Survey results, with 91% of employees indicating that they are proud to work at BlackRock and over 80% feeling that BlackRock is invested in their well-being. | ||||||

• Prioritized the health and safety of employees during the pandemic, providing COVID-19 testing globally, free telemedicine options and additional support for families.

| ||||||

Amounts are shown on an “as adjusted” basis. For a reconciliation with GAAP, |

Traditional Peers refers to public company asset managers: Alliance Bernstein, Affiliated Managers Group, |

NTM P/E multiple refers to the Company’s share price as of December 31, |

In addition to annual incentive awards, the Compensation Committee expects to continue to make annual grants of long-term equity awards to both Messrs. Fink and Kapito, with at least half of such awards being contingent on future financial or other business performance requirements in addition to share price performance.

6BLACKROCK, INC. 2018 PROXY STATEMENT

| BLACKROCK, INC. 2021 PROXY STATEMENT |  |

Proxy Summary | Compensation Discussion and Analysis Highlights

NEO Total Annual Compensation Summary

Following a review of full-year business and individual Named Executive Officer (“NEO”)NEO performance, the Compensation Committee determined 20172020 total annual compensation outcomes for each NEO, as outlined in the table below.

| 2017 Annual Incentive Award |

| 2020 Total Incentive Award

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||

Name

| Base

| Cash

| Deferred

| Long-Term

| Total Annual

| % change in

| Performance-

| Base Salary | Cash | Deferred Equity | Long-Term Incentive Award (BPIP) | Total Annual Compensation (“TAC”) | % change in TAC vs. 2019 | |||||||||||||||||||||||||||||||||||||||

Laurence D. Fink

| $

| 900,000

|

| $

| 10,000,000

|

| $

| 4,600,000

|

| $

| 12,450,000

|

| $

| 27,950,000

|

|

| 10%

|

|

| –

|

|

| $1,500,000 |

|

| $9,500,000 |

|

| $3,950,000 |

|

| $14,900,000 |

|

| $29,850,000 |

|

| 18% |

| |||||||||||||

Robert S. Kapito

| $

| 750,000

|

| $

| 8,125,000

|

| $

| 3,514,000

|

| $

| 9,626,000

|

| $

| 22,015,000

|

|

| 10%

|

|

| –

|

|

| $1,250,000 |

|

| $8,250,000 |

|

| $3,937,500 |

|

| $11,187,500 |

|

| $24,625,000 |

|

| 23% |

| |||||||||||||

Robert L. Goldstein

| $

| 500,000

|

| $

| 3,275,000

|

| $

| 2,325,000

|

| $

| 2,100,000

|

| $

| 8,200,000

|

|

| 12%

|

| $

| 10,000,000

|

|

| $500,000 |

|

| $3,175,000 |

|

| $2,325,000 |

|

| $5,750,000 |

|

| $11,750,000 |

|

| 19% |

| |||||||||||||

Mark S. McCombe

| $

| 500,000

|

| $

| 2,725,000

|

| $

| 1,775,000

|

| $

| 1,950,000

|

| $

| 6,950,000

|

|

| 11%

|

| $

| 10,000,000

|

| |||||||||||||||||||||||||||||||

Mark Wiedman |

| $500,000 |

|

| $2,675,000 |

|

| $1,725,000 |

|

| $5,600,000 |

|

| $10,500,000 |

|

| 24% |

| ||||||||||||||||||||||||||||||||||

Gary S. Shedlin

| $

| 500,000

|

| $

| 2,700,000

|

| $

| 1,750,000

|

| $

| 1,850,000

|

| $

| 6,800,000

|

|

| 11%

|

| $

| 7,500,000

|

|

| $500,000 |

|

| $2,800,000 |

|

| $1,850,000 |

|

| $3,350,000 |

|

| $8,500,000 |

|

| 18% |

| |||||||||||||

The amounts listed above as “2017 Annual“2020 Total Incentive Award: Deferred Equity”Equity” and “Long-Term“2020 Total Incentive Award: Long-Term Incentive Award (“BPIP”)(BPIP)” were granted in January 20182021 in the form of equity and are separate fromin addition to the cash award amounts listed above as “2017 Annual“2020 Total Incentive Award: Cash.Cash.” In conformance with SEC requirements, the 2017“2020 Summary Compensation Table” on page 6882 reports equity in the year granted but cash in the year earned.

In the fourth quarter of 2017, BlackRock implemented a key strategic part of our long-term management succession plans by granting long-term incentive awards in the form of performance-based stock options to a select group of senior leaders, excluding the CEO and President, who we believe will play critical roles in BlackRock’s future. Consequently, we do not consider these awards to be part of our regular annual compensation determinations for 2017. For more information regarding these performance-based stock options, see “Performance-Based Stock Options” on page 55.

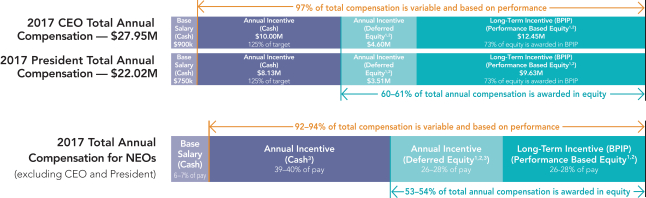

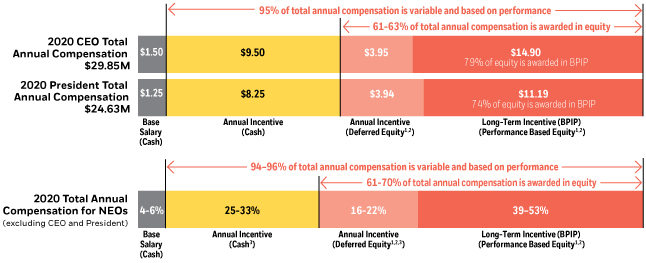

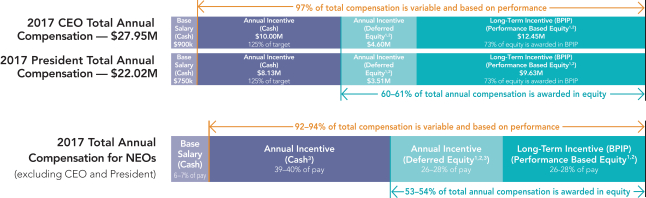

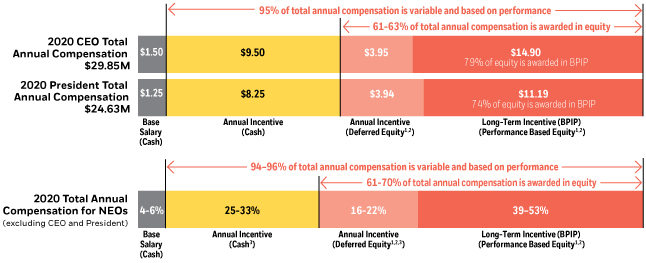

Pay-for-Performance Compensation Structure for NEOs

Our total annual compensation structure embodies our commitment to align pay with performance. More than 90% of our regular annual executive compensation is performance based and “at risk.” Compensation mix percentages shown below are based on 20172020 year-end compensation decisions for individual NEOs by the Compensation Committee.

All grants of BlackRock equity, |

The value of the |

For NEOs other than the CEO and President, higher annual incentive awards are subject to higher deferral percentages, in accordance with the Company’s deferral policy, as detailed on page |

2017 CEO Total Annual Compensation-$27.95M Base Salary (Cash) $900k 97% of total compensation is variable and based on performance Annual Incentive (Cash) $10.00M 125% of target Annual Incentive (Deferred Equity1,2) $4.6M Long-Term Incentive (BPIP) (Performance Based Equity1,2) $12.45M 75% of equity is awarded in BPIP 2017 President Total Annual Compensation- $22.02M Base Salary (Cash) $750k Annual Incentive (Cash) $8.13M 125% of target Annual Incentive (Deferred Equity1,2) $3.51M Long-Term Incentive (BPIP) (Performance Based Equity1,2) $9.63M 75% of equity is awarded in BPIP 60-61% of total annual compensation is awarded in equity 2017 Total Annual Compensation for NEOs (excluding CEO and President) Base Salary (Cash) 7-8% of pay 92-94% of total compensation is variable and based on performance Annual Incentive (Cash3) 39-40% of pay Annual Incentive (Deferred Equity1,2,3) 26-28% of pay Long-Term Incentive (BPIP) (Performance Based Equity1,2) 26-28% of pay 53-54% of total annual compensation is awarded in equity

BLACKROCK, INC. 2018 PROXY STATEMENT 7

10 | BLACKROCK, INC. 2021 PROXY STATEMENT |

Election of

Directors

“BlackRock’sBoard plays an integral role in our governance, strategy, growth and success. It has always been important that our Board functions as a key strategic governing body that both challenges and advises our leadership team and guides BlackRock into the future.” Laurence D. Fink Chairman and Chief Executive Officer | Our Board has nominated 16 directors for election at this year’s Annual Meeting on the recommendation of our Governance Committee. Each director will serve until our next annual meeting and until his or her successor has been duly elected, or until his or her earlier death, resignation or retirement. We expect each director nominee to be able to serve if elected. If a nominee is unable to serve, proxies will be voted in favor of the remainder of those directors nominated and may be voted for substitute nominees, unless the Board decides to reduce its total size. If all 16 director nominees are elected, our Board will consist of 16 directors, 14 of whom, representing approximately 88% of the Board, will be “independent” as defined in the NYSE listing standards. Majority Vote Standard for Election of Directors Directors are elected by receiving a majority of the votes cast in uncontested elections, which means the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that director nominee. In a contested election, directors are elected by receiving a plurality of the shares represented in person or by proxy at any meeting and entitled to vote on the election of directors. A contested election is a situation in which the number of nominees exceeds the number of directors to be elected. Whether an election is contested is determined seven days in advance of when we file our definitive Proxy Statement with the SEC. Director Resignation Policy Under the Board’s Director Resignation Policy, any incumbent director who fails to receive a majority of votes cast in an uncontested election must tender his or her resignation to the Board. The Governance Committee will then make a recommendation to the Board about whether to accept or reject the resignation or take other action. The Board will act on the Governance Committee’s recommendation and publicly disclose its decision and rationale within 90 days from the date the election results are certified. The director who tenders his or her resignation under the Director Resignation Policy will not participate in the Board’s decision. |

| BLACKROCK, INC. 2021 PROXY STATEMENT | 11 |

Our Board has nominated 18 directors for election at this year’s Annual Meeting on the recommendation of our Governance Committee. Each director will serve until our next annual meeting and until his or her successor has been duly elected, or until his or her earlier death, resignation or retirement.

We expect each director nominee to be able to serve if elected. If a nominee is unable to serve, proxies will be voted in favor of the remainder of those directors nominated and may be voted for substitute nominees, unless the Board decides to reduce its total size.

If all 18 nominees are elected, our Board will consist of 18 directors, 15 of whom, representing approximately 83% of the Board, will be “independent” as defined in the New York Stock Exchange (the “NYSE”) listing standards.

Stockholder Agreement with The PNC Financial Services Group, Inc.

BlackRock’s stockholder agreement with The PNC Financial Services Group, Inc. (the “PNC Stockholder Agreement”) provides, subject to the waiver provisions of the agreement, that BlackRock will use its best efforts to cause the election at each annual meeting of shareholders so that the Board will consist of:

The PNC Financial Services Group, Inc. (“PNC”) has designated one member of the Board, William S. Demchak, Chairman, President and Chief Executive Officer of PNC. PNC has notified BlackRock that for the time being it will not designate a second director to the Board, although it retains the right to do so at any time in accordance with the PNC Stockholder Agreement. PNC has additionally been permitted to invite an observer to attend meetings of the Board as anon-voting guest. The PNC observer is Gregory B. Jordan, the General Counsel and Head of Regulatory and Governmental Affairs of PNC. Laurence D. Fink and Robert S. Kapito are members of BlackRock’s management team and are currently members of the Board. For additional detail on the PNC Stockholder Agreement, see“Certain Relationships and Related Transactions – PNC Stockholder Agreement” on page 40.

8BLACKROCK, INC. 2018 PROXY STATEMENT

It has always been important that BlackRock’s Board of Directors functions as a key strategic and governing body that challenges our leadership team to be better and more innovative. Laurence D. Fink Chairman and Chief Executive Officer

ITEM 1: |

Majority Vote Standard for Election of Directors

Directors are elected by a majority of the votes cast in uncontested elections (the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that director nominee). In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors would be a plurality of the shares represented in person or by proxy at any meeting and entitled to vote on the election of directors. Whether an election is contested is determined seven days in advance of when we file our definitive Proxy Statement with the SEC.

| Director Resignation Policy and Mandatory Retirement AgeNominees

Under the Board’s Director Resignation Policy, any incumbent director who fails to receive a majority of votes cast in an uncontested election must tender his or her resignation to the Board. The Governance Committee would then make a recommendation to the Board about whether to accept or reject the resignation or take other action. The Board will act on the Governance Committee’s recommendation and publicly disclose its decision and rationale within 90 days from the date the election results are certified. The director who tenders his or her resignation under the Director Resignation Policy will not participate in the Board’s decision.

The Board has established a mandatory retirement age of 75 years for directors, as reflected in BlackRock’s Corporate Governance Guidelines.

The Governance Committee oversees the director nomination process. The Governance Committee leads the Board’s annual review of Board performance and reviews and recommends to the Board BlackRock’s Corporate Governance Guidelines, which include the minimum criteria for membership on the Board.Board membership. The Governance Committee also assists the Board in identifying individuals qualified to become Board members and recommends to the Board a slate of candidates, which may include both incumbent and new director nominees, to submitnominate for election at each annual meeting of shareholders. The Governance Committee also may also recommend that the Board elect new members to the Board to serve until the next annual meeting of shareholders.

Identifying and Evaluating Candidates for Director

The Governance Committee seeks advice on potential director candidates from current directors and executive officers when identifying and evaluating new candidates for director. The Governance Committee also may direct management to engage third-party firms that specialize in identifying director candidates to assist with its search. Shareholders can recommend a candidate for election to the Board by submitting director recommendations to the Governance Committee. For information on the requirements governing shareholder nominations for the election of directors, pleaseseeplease see “Deadlines for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders”on page 92.107.

The Governance Committee then reviews publicly available information regarding each potential director candidate to assess whether the candidate should be considered further. If the Governance Committee determines that the candidate warrants further consideration, then the Chairperson (or a person designated by the Governance Committee) will contact the candidate. If the candidate expresses a willingness to be considered and to serve on the Board, then the Governance Committee typically requests information from the candidate and reviews the candidate’s accomplishments and qualifications against the criteria described below.

The Governance Committee’s evaluation process does not vary based on whether a candidate is recommended by a shareholder, although the Governance Committee may consider the number of shares held by the recommending shareholder and the length of time that such shares have been held.

In March of this year, the Governance Committee identified Hans E. Vestberg as a candidate with significant leadership and experience in international business, Continental Europe, sustainability and the technology sector, and recommended him to the Board for consideration. Mr. Vestberg was recommended for consideration to the Governance Committee by our CEO. On March 24, 2021, the Board voted unanimously to nominate Mr. Vestberg for election at the Annual Meeting.

Each year, the Board determines the independence of directors in accordance with NYSE listing standards and applicable SEC rules. No director is considered independent unless the Board has determined that he or she has no material relationship with BlackRock.

The Board has adopted the Categorical Standards of Director Independence (the “Categorical Standards”) to help determine whether certain relationships between the members of the Board and BlackRock or its affiliates and subsidiaries (either directly or as a partner, shareholder or officer of an organization that has a relationship with BlackRock) are material relationships for purposes of NYSE listing standards. The Categorical Standards provide that the following relationships are not material for such purposes:

Relationships arising in the ordinary course of business, such as asset management, acting as trustee, lending, deposit, banking or other financial service relationships or other relationships involving the provision of products or services, so long as the products and services are being provided in the ordinary course of business and on substantially the same terms and conditions, including price, as would be available to similarly situated customers;

BLACKROCK, INC. 2018 PROXY STATEMENT 9

ITEM 1: Election of Directors | Criteria for Board Membership

Relationships with companies of which a director is a shareholder or partnerships of which a director is a partner, provided the director is not a principal shareholder of the company or a principal partner of the partnership;

Contributions made or pledged to charitable organizations of which a director or an immediate family member of the director is an executive officer, director or trustee if (i) within the preceding three years, the aggregate amount of such contributions during any single fiscal year of the charitable organization did not exceed the greater of $1 million or 2% of the charitable organization’s consolidated gross revenues for that fiscal year and (ii) the charitable organization is not a family foundation created by the director or an immediate family member of the director; and

Relationships involving a director’s relative unless the relative is an immediate family member of the director.

As part of its determination, the Board also considers the relationships described under “Certain Relationships and Related Transactions” on page 50.

In March 2021, the Governance Committee made a recommendation to the Board regarding the independence of our director nominees based on its annual review. In making its independence determinations, the Governance Committee and the Board considered various transactions and relationships between BlackRock and the director nominees as well as between BlackRock and entities affiliated with a director nominee, including the relationships described under “Certain Relationships and Related Transactions” on page 50. The Governance Committee also considered that Messrs. Robbins and Vestberg are, and Ms. Johnson was, employed by organizations that do business with BlackRock, where each of such transactional relationships was for the purchase or sale of goods and services in the ordinary course of BlackRock’s business, and the amount received by BlackRock or such company in each of the previous three years did not exceed the greater of $1 million or 2% of either BlackRock’s or such organization’s consolidated gross revenues. As a result of this review, the Board determined that Mses. Daley, Einhorn, Johnson, Mills and Wagner and Messrs. Alsaad, Ford, Freda, Gerber, Nixon, Robbins, Slim, Vestberg and Wilson are “independent” as defined in the NYSE listing standards and that none of the relationships between these director nominees and BlackRock are material under the NYSE listing standards. In addition, the Board had previously determined that Ivan G. Seidenberg, who retired from the Board effective May 21, 2020, and Mathis Cabiallavetta, who was a director for all of 2020 and is not standing for re-election, were “independent” as defined in the NYSE listing standards.

Following the Annual Meeting, assuming all of the nominated directors are elected, BlackRock’s Board is expected to consist of 16 directors, 14 of whom, representing approximately 88% of the Board, will be “independent” as defined in the NYSE listing standards.

Director Qualifications and Attributes

The Governance Committee and the Board take into consideration a number of factors and criteria inwhen reviewing candidates for nomination to the Board. The Board believes that, at a minimum, a director candidatenominee must demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of BlackRock. Equally important, a director candidatenominee must have an impeccable record and reputation for honest and ethical conduct in his or her professional and personal activities.

In addition, nominees for director are selected on the basis of experience, diversity, knowledge, skills, expertise, ability to make independent analytical inquiries, understanding of BlackRock’s business environment and a willingness to devote adequate time and effort to the responsibilities of the Board.

BlackRock and its Board believe diversity in the boardroom is critical to the success of the Company and its ability to create long-term value for our shareholders. The Board has and will continue to make diversity in gender, race/ethnicity, age, career experience and geographic locationnationality – as well as diversity of mind – a priority when considering director candidates. The diverse backgrounds of our individual directors help the Board better evaluateoversee BlackRock’s management and operations and assess risk and opportunities for the Company’s business model.model from a variety of perspectives. BlackRock’s commitment to Board diversity enhances Boardthe Board’s involvement in our Company’s multi-facetedmultifaceted long-term strategy and inspires deeper engagement with management, employees and clients around the world.

Our Board has nominated 18 directors16 candidates for election, 1514 of whom are independent. The Boardslate of director nominees includes 5five women 1 of whom is African American, and 6 directors who aresix non-U.S. or dual citizens. Several of our nominees live and work overseas in countries and regions that are key areas of growth and investment for BlackRock, including Canada, Mexico, Canada, the United KingdomMiddle East and Continental Europe.

Additionally, beginning this year, we asked each director nominee to self-identify as to his or her racial/ethnic diversity. Based on the responses, three of our 14 independent director nominees self-identified as racially/ethnically diverse, with one as Black/African American, one as Hispanic/Latin American and one as Middle-Eastern/North African.

| BLACKROCK, INC. 2021 PROXY STATEMENT | 13 |

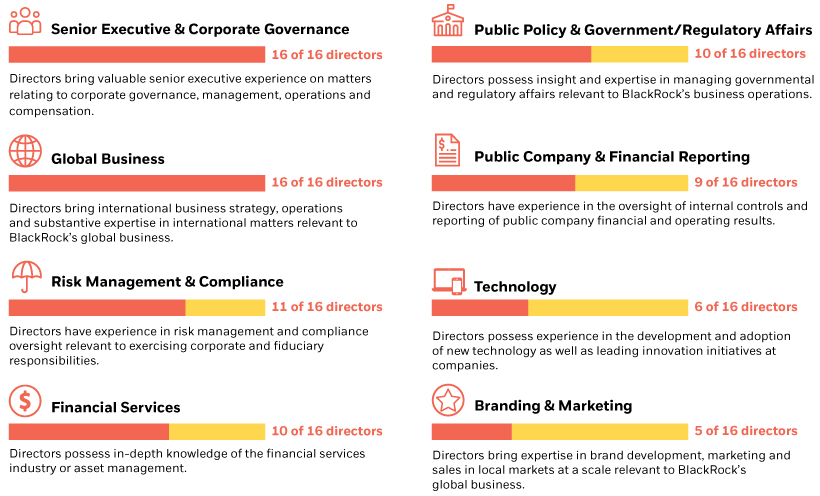

ITEM 1: Election of Directors | Criteria for Board Membership

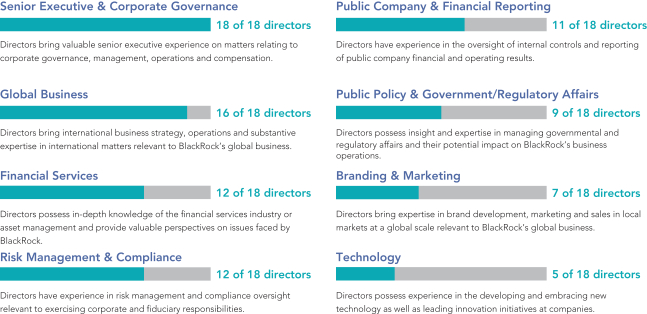

As BlackRock’s business has evolved, so has itsour Board. Our Boardslate of director nominees consists of senior leaders, (includingincluding 12 current or former company CEOs)CEOs, with substantial experience in financial services, consumer products, manufacturing, technology, banking and energy, andas well as several directorsdirector nominees who have held senior policy and government positions. To learn more about our Board, we encourage you to visit our website athttp://ir.blackrock.com/board-of-directors. Core qualifications and areas of expertise represented on our Board include:

10BLACKROCK, INC. 2018 PROXY STATEMENT

Board Tenure, Retirement Age and Size

Board Tenure.To ensure the Board has an appropriate balance of experience, continuity and fresh perspective, the Board considers, among other factors, length of tenure when reviewing nominees. The average tenure of BlackRock’s director nominees is approximately 7eight years whileand the average tenure forof independent director nominees is approximately 5six years.

SixFollowing the Annual Meeting, assuming all of the nominated directors are elected, there will be six directors, comprising 33%38% of the Board, who have joined the Board within the past five years and bring fresh perspective to Board deliberations. Seven directors, comprising 44% of the Board, have served between five and 10 years. Three directors, comprising 19% of the Board, have served more than 10 years and bring a wealth of experience and knowledge concerning BlackRock. Five(1) The Board believes it is important to balance refreshment with the need to retain directors comprising 28%who have developed, over time, significant insight into the Company and its operations and who continue to make valuable contributions to the Company that benefit our shareholders.

Retirement Age. The Board has established a retirement age policy of 75 years for directors, as reflected in our Corporate Governance Guidelines. The Board believes that it is important to monitor its composition, skills and needs in the context of the Company’s long-term strategic goals, and, therefore, may elect to waive the policy as it deems appropriate.

Board have served between 5 and 10 years.

Following the 2018 Annual Meeting of Shareholders, assuming all of the nominated directors are elected, there will be seven directors, comprising 39% of the Board, who have joined the Board within the past 5 years and bring fresh perspective to Board deliberations.

Size.The Board has not adopted a policy that limits or sets a target for Board size and believes the current size and diverse composition of the Board is best suited to evaluate management’s performance and oversee BlackRock’s global strategy, complex operations and risk management. The range of insights and experience of our Board supports BlackRock’s business and strategic growth areas, which include our diverse platform of alpha-seeking active, index and cash management investment strategies across asset classes, as well as technology services and advisory services and solutions.

| (1) | Percentages do not sum to 100% due to rounding |

14 | BLACKROCK, INC. 2021 PROXY STATEMENT |

ITEM 1: Election of Directors | Criteria for Board Membership

As described in“Board Evaluation Process” on page 23,28, the Governance Committee and the Board evaluate Board and Committee performance and effectiveness on at least an annual basis and, as part of that process, ask each director to consider whether the size of the Board and its standing Committees are appropriate. In response to the 2020 Board and Committee evaluations, directors praised the open, collaborative and highly engaged Board culture. Our directors also commented that the size and structure of the Board promotes diversity of thought and engagement, and it was noted that thoughtful consideration has been given to the refreshment of Board members.

Compliance with Regulatory and Independence Requirements

The Governance Committee takes into consideration regulatory requirements, including competitive restrictions, and financial institution interlocks, independence requirements under the NYSE listing standards and our Corporate Governance Guidelines, in its review of director candidates for the Board and its Committees. The Governance Committee also considers a director candidate’s current and past positions held, including past and present board and committee memberships, as part of its evaluation.

Service on Other Public Company Boards

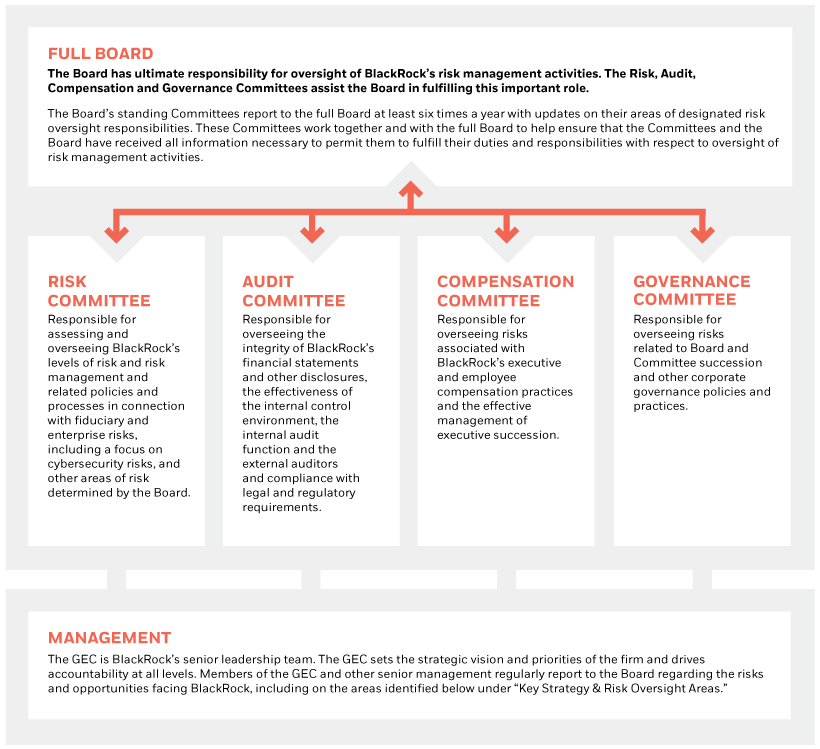

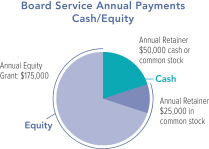

Each of our directors must have the time and ability to make a constructive contribution to the Board as well as a clear commitment to fulfilling the fiduciary duties required of directors and serving the interests of the Company’s shareholders. Neither BlackRock’s CEO does notnor President currently serveserves on the board of directors of any other public company, and none of our current directors serve on more than four public company boards, including BlackRock’s Board.